Flipkart has initiated talks with India’s top online furniture marketplace Pepperfry for a strategic investment, said four people familiar with the matter, as the ecommerce giant explores ways to diversify its business through acquisitions and investments. The discussions, held last month, are preliminary and there is no guarantee a transaction will take place, these people said, declining to share more specific details or be identified.

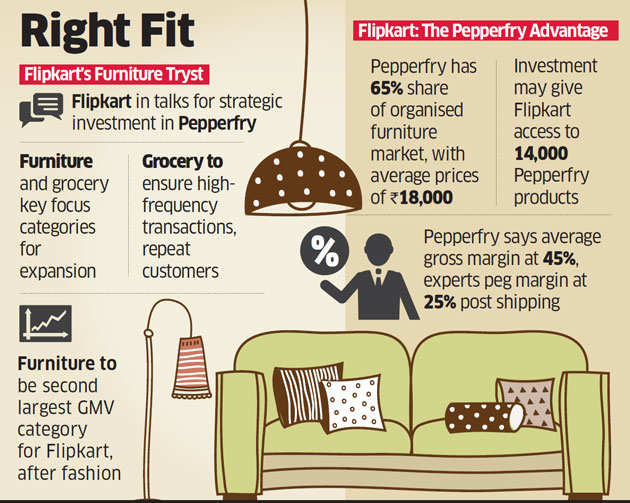

With $4 billion in the bank, India’s largest online marketplace is aggressively scouting for opportunities in categories that can bring high repeat purchases or offer high prices, these people said. Flipkart soft-launched its grocery business last week and re-launched its furniture business in September, after having ventured briefly into both categories earlier.

Flipkart declined to comment on its talks with Pepperfry. A spokeswoman for the furniture marketplace did not offer a comment either, only saying: “As a practice, we do not comment on market speculation.”

For Flipkart, an investment in Pepperfry would open the doors to a category that racks up high gross margins, second only to the fashion category. Flipkart registers margins of 20-40% in its fashion business, with its own labels yielding the higher end of the range.

Pepperfry, which commands a 65% share of India’s organised furniture market, on average makes gross margins of about 45% on products that include home furnishings and appliances. Margins from its furniture category, which makes up about 80% of its offerings, hover at 55%, according to the company. Analysts peg the company’s margins at a more modest 25% after accounting for shipping costs. The average pricing in Pepperfry’s furniture category is about Rs 18,000.

Flipkart had also initiated talks with Pepperfry’s rival Urban Ladder for a possible acquisition, according to a Mint report last month. SAIF Partners and Steadview Capital-backed online furniture retailer, however, denied any deal with Flipkart, the report said. An investment in Pepperfry, if it materialises, will give Flipkart access to the furniture marketplace’s catalogue of more than 14,000 items — a prize catch in a domestic market that is 85% unorganised.

As for India’s online homeware and furniture retail market, it is expected to cross $1.1 billion in revenue this year, up from about $900 million in 2016, according to industry estimates.

Analysts say Flipkart is making a long-term bet on the furniture category, which may yield results in 3-5 years. “Furniture is a fairly insignificant category for Flipkart at the moment,” said Anil Kumar, chief executive, RedSeer Consulting.

“The company is slowly building out their furniture category as a long-term bet to increase their GMV (gross merchandise volume, a proxy for gross sales).”

For Flipkart, large appliances form the third biggest category in terms of revenue. The company said in August that it was looking to increase the revenue contribution from its large appliances category to 12-15% by March from 3-4% now.

Pepperfry is the latest among a long list of companies that Flipkart has been in talks with for investments or acquisitions as it seeks to position itself as an ecommerce conglomerate, similar to some of China’s large internet companies.

ET reported on Monday that the Bengaluru-headquartered company had held talks with Swiggy, BookMyShow and other firms as it sought to establish its presence across categories, including food, grocery and furniture.

Post your comments

You must be logged in to post a comment.